Our advisors have a singular focus: our clients’ financial well being

Clients

Our advisors have a singular focus: our clients’ financial well being

Clients

Who We Work With

Everything we do is with our clients’ well-being top of mind

High Net Worth Individuals and Families

High Net Worth individuals and families require a different level of attention, and sometimes that means extremely complex financial considerations. Our financial professionals guide you through all market conditions, offering valuable counsel and insight every step of the way.

Business Owners

What’s next for your business? Planning ahead can be complicated. Our goal is to help owners identify opportunities and risks well in advance so that you can get the most out of your business now, and when it is time to pass the torch.

Retirees

Retirement means something different for everyone – lets us help you define yours, and confidently pursue it.

Pre-retirees

It’s never too early to plan for retirement, and to design what it looks like for you and your family. Let our experienced team provide their perspective.

Client Services

What We Do for Individuals and Business Owners

Retirement Planning

Investment Management

Business Planning

Estate Planning

Corporate Benefits

Group Benefits

Insurance Strategies

Retiring with Confidence

As you approach retirement, you suddenly face a lot of questions:

Do I have enough?

Have we saved enough?

How much money do we need to retire comfortably?

Are we going to be okay?

We spend a lifetime accumulating assets to retire without ever really considering what’s at the end of the tunnel.

That is why Integrated Partners created the Lifetime Income ModelTM (LIM). Through careful time segmentation, we leverage opportunity (harnessing the power of growth assets over time) and certainty (distributions to meet needs from fixed low volatility asset) to help create retirement confidence.

Traditional retirement plans worked well enough in the past – but changing market conditions have made it increasingly risky. Low interest rates have sent bond income plummeting and this approach doesn’t take into account the impact of taking assets during market declines.

LIM keeps money you’ll need in the shorter term in safer investments that are easily converted to cash, so that the longer-term money can harness the power of time to grow.

The Lifetime Income Model is designed specifically to tackle that shortfall risk, maximize the probability of funding your unique retirement goals, and create confidence.

Integrated Financial Solutions

Putting structure around the more common challenges our clients face

Lifetime Income Model™

Retirees must make important decisions about their future. Do I have enough money to retire the way I want? Is it in the right places? How can I maximize tax efficiency?

Lifetime Income Model™

Retirees must make important decisions about their future. Do I have enough money to retire the way I want? Is it in the right places? How can I maximize tax efficiency?

The Legacy Discussion™

Estate planning is often among the least prioritized financial considerations – but is in fact among the most important. How do I want my assets distributed when I’m gone? How much control should my heirs have? How do I minimize the tax burden on my family.

The Legacy Discussion™

Estate planning is often among the least prioritized financial considerations – but is in fact among the most important. How do I want my assets distributed when I’m gone? How much control should my heirs have? How do I minimize the tax burden on my family.

The Family Office™

"High Net Worth and Ultra High Net Worth" families often lead very complex lives, which includes the management of their finances. The key is staying organized, structured and simplifying where possible.

The Family Office™

"High Net Worth and Ultra High Net Worth" families often lead very complex lives, which includes the management of their finances. The key is staying organized, structured and simplifying where possible.

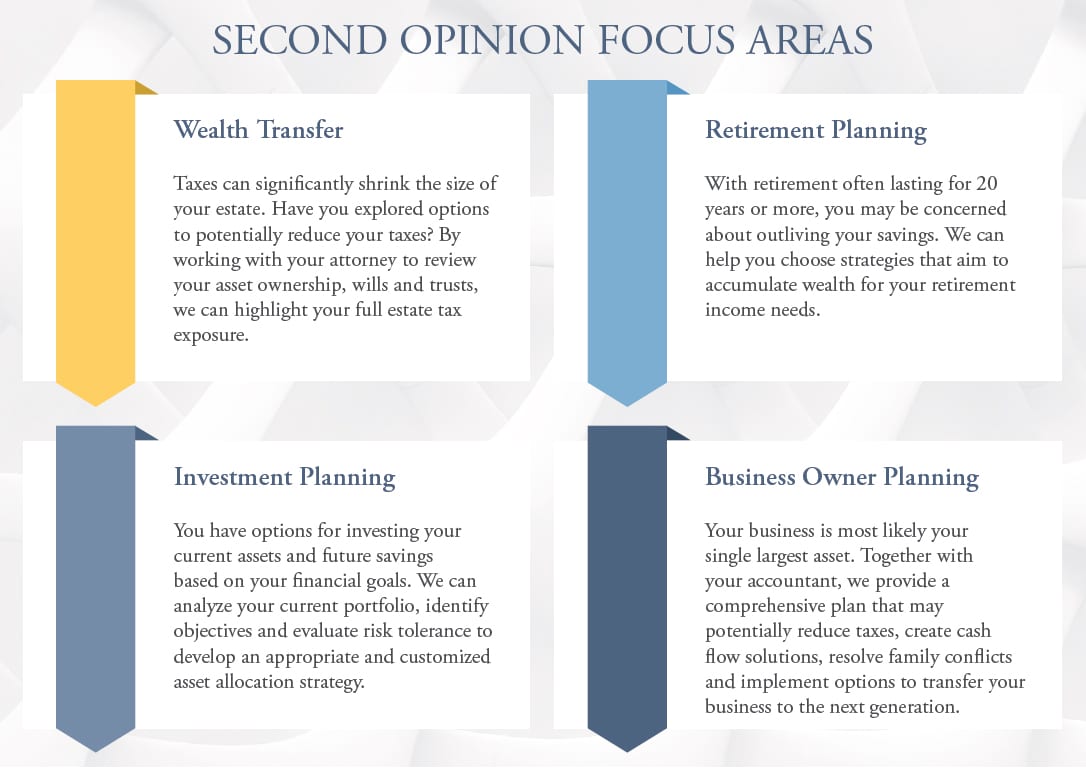

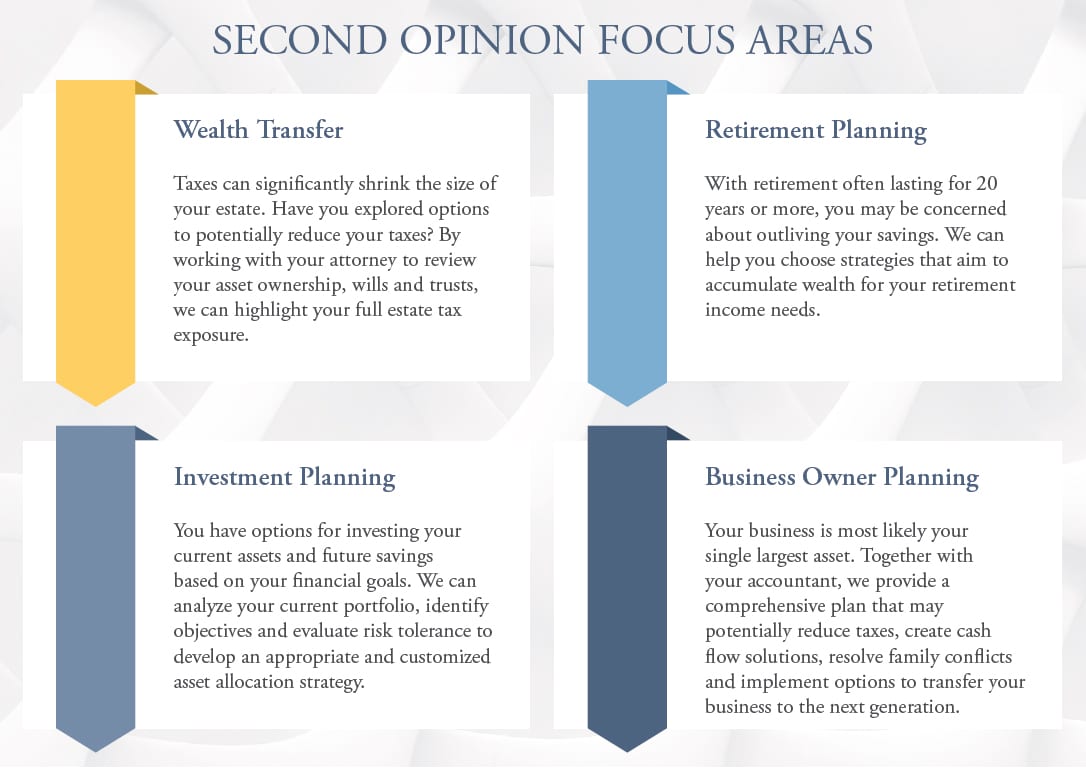

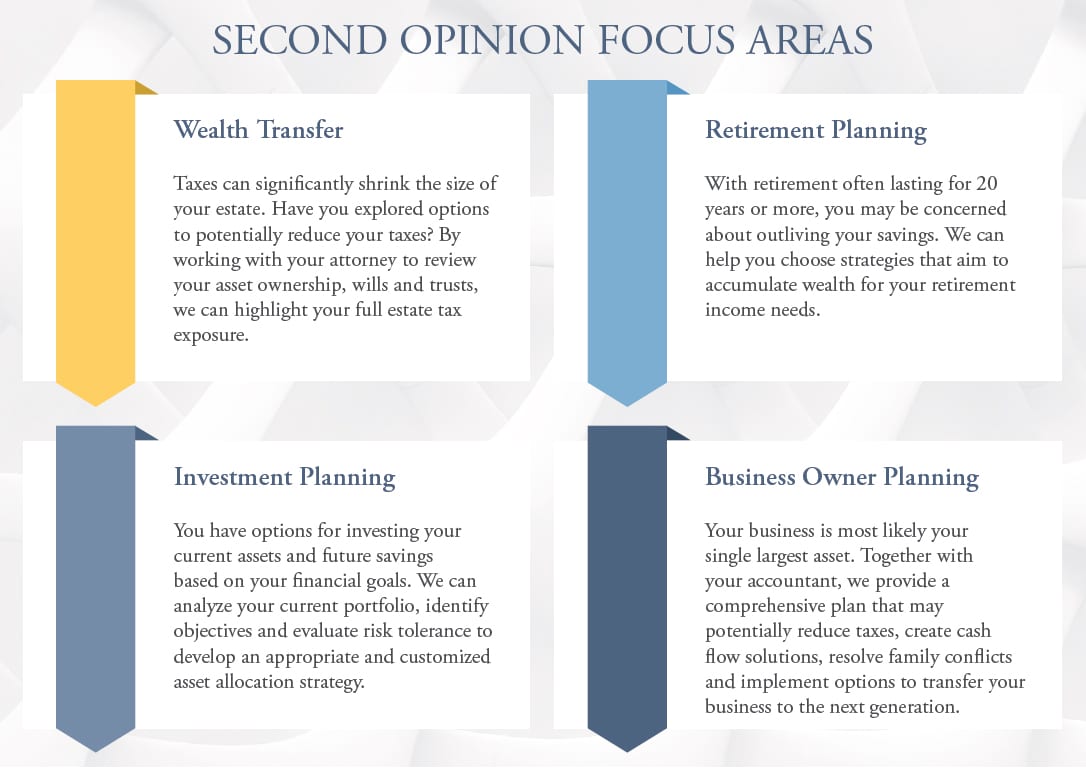

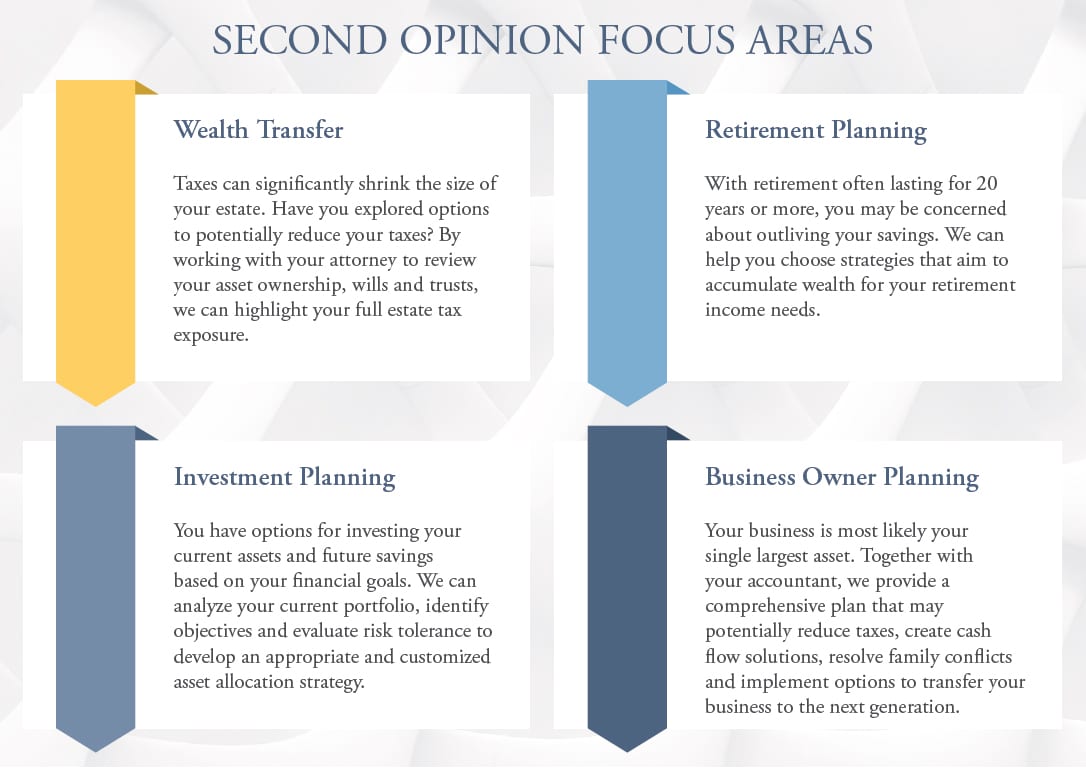

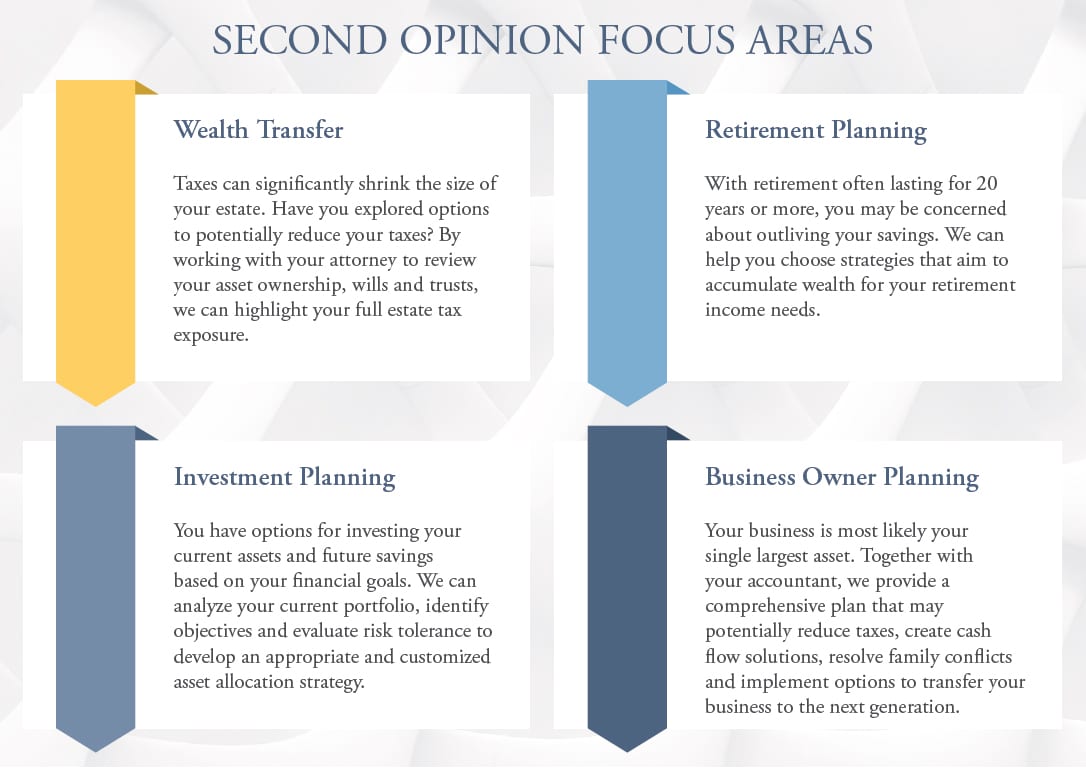

The Financial Second Opinion™

The financial health of an individual or family is second only to their physical health. Asking for second opinions from doctors is common practice – so should it be with financial advisors. Get a no obligation review of your financial affairs and a candid Green, Yellow or Red light report that breaks down where you stand.

The Financial Second Opinion™

The financial health of an individual or family is second only to their physical health. Asking for second opinions from doctors is common practice – so should it be with financial advisors. Get a no obligation review of your financial affairs and a candid Green, Yellow or Red light report that breaks down where you stand.

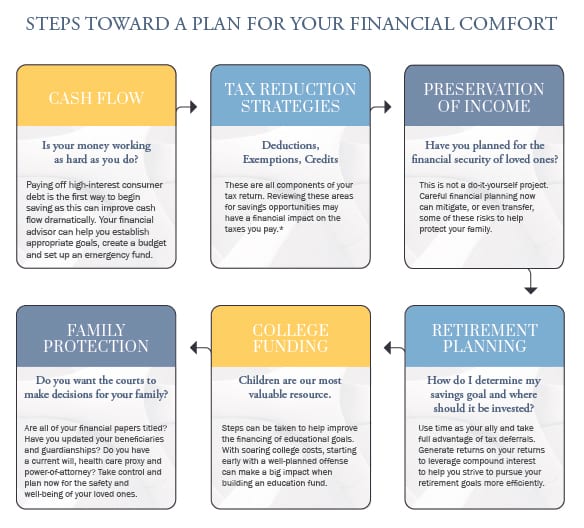

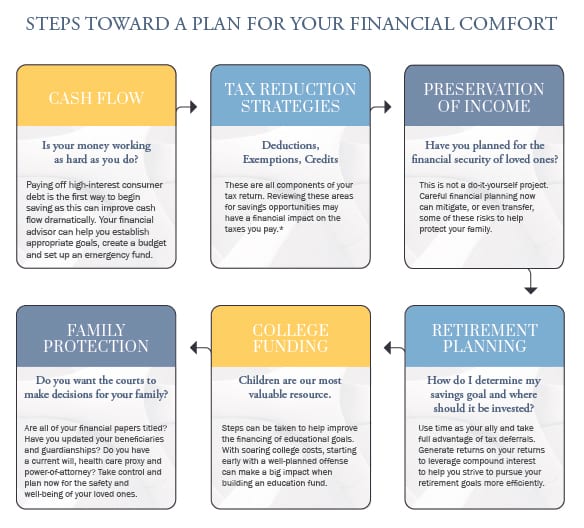

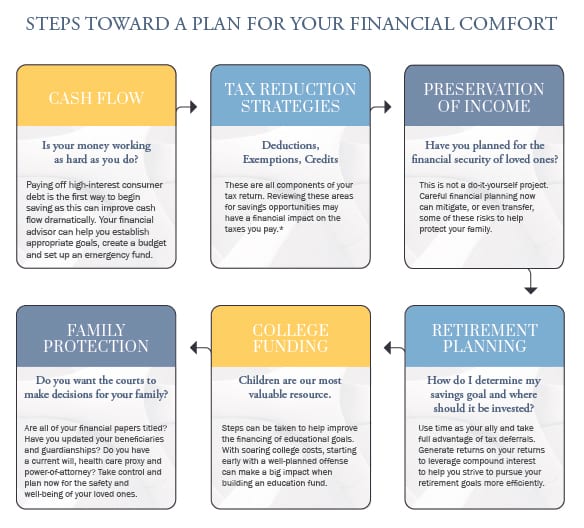

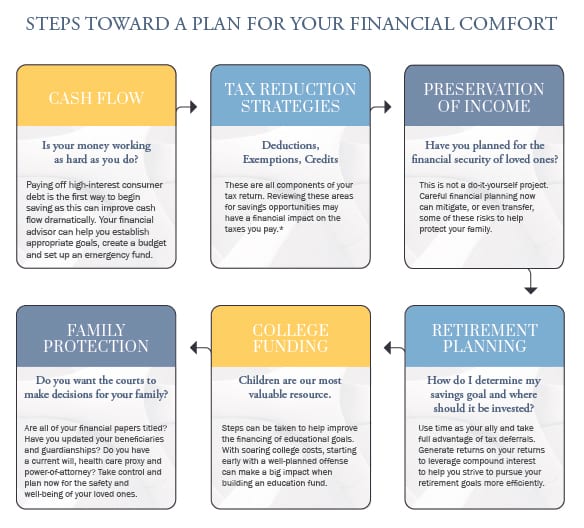

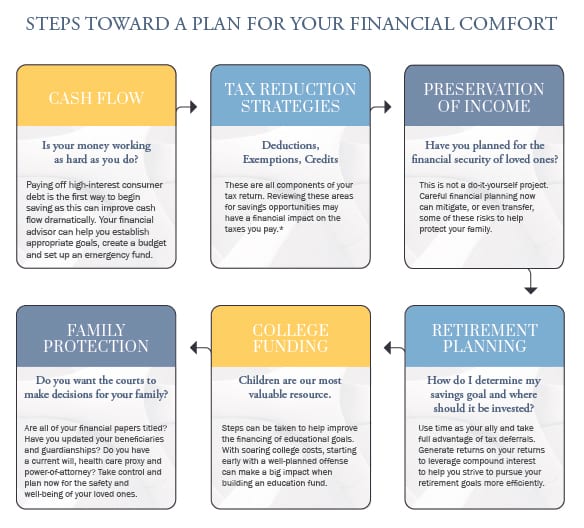

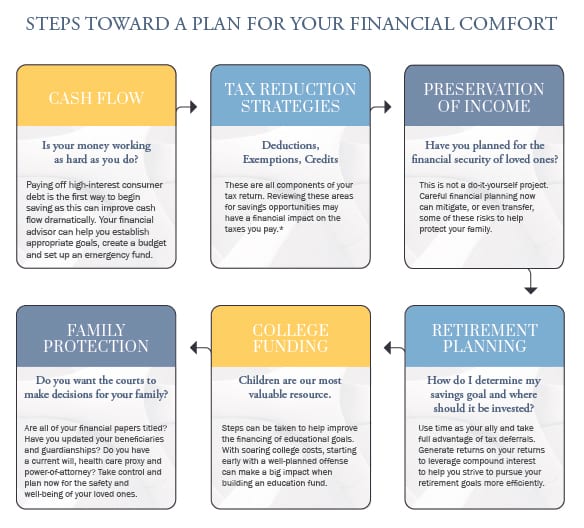

Plan for Financial Comfort™

Life is full of the unexpected and of things that happen sooner than expected. Major events, transfer of assets, loss of a job, new baby, divorce, death – the list goes on. Have a contingency plan ready, so you are prepared for the unexpected.

Plan for Financial Comfort™

Life is full of the unexpected and of things that happen sooner than expected. Major events, transfer of assets, loss of a job, new baby, divorce, death – the list goes on. Have a contingency plan ready, so you are prepared for the unexpected.

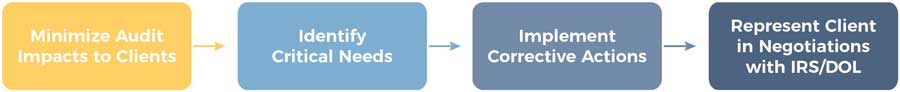

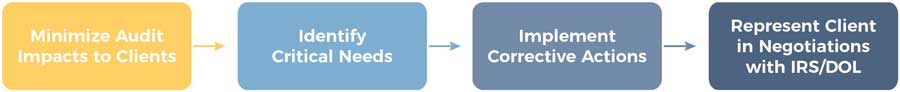

The Integrated 401(k)™

Many people have 401(k) plans – few truly understand them. Integrate your 401(k) plan with educational resources for plan participants. Maximize 401(k) plan design and get to know what you don’t know.

The Integrated 401(k)™

Many people have 401(k) plans – few truly understand them. Integrate your 401(k) plan with educational resources for plan participants. Maximize 401(k) plan design and get to know what you don’t know.

No strategy assures success or protects against loss.